Tax management is highly essential because it will enable proper and timely computation of taxes, hence minimizing the risk of mistakes.

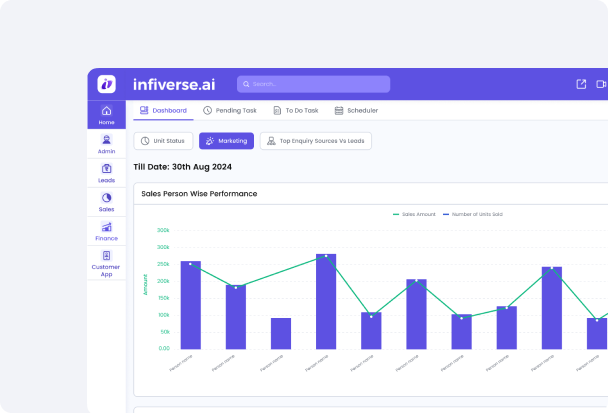

When technology, like software systems, tools, and algorithms, is used to figure out the right amount of taxes a person or business owes, this is called automated tax calculations. This automation process gets rid of the need to do calculations by hand, cuts down on mistakes, and makes sure that tax laws and rules are followed, even as they change. It is an important part of modern business tax management because it makes the process of figuring out taxes faster and more accurate. Most of the time, accounting, enterprise resource planning (ERP), or tax-specific software includes automated tax calculations. Tax rates, rules, and real-time data are used by these systems to accurately figure out taxes based on things like income, location, and type of transaction. This automation cuts down on mistakes, saves time, and helps businesses make sure they follow tax laws quickly.

Automated tax calculations are when technology-such as software systems, tools, and algorithms-are used to determine the exact or right amount of taxes that a person or business owes. This process eliminates the need for hand calculations. Instead, it curtails mistakes and, above all, ensures that there would be adherence to tax laws and regulations as their changes are implemented. It is an integral part of modern business tax management because it makes the determination of taxes faster and more precise. Most frequently, automated tax calculations occur in accounting, enterprise resource planning, or tax-specific software. This depends on tax rates, rules, and real-time data for exactly figuring taxes based on items like income, location, and even the type of transaction. Error is reduced and time saved as business ensures rapid compliance with tax regulations due to its automation.

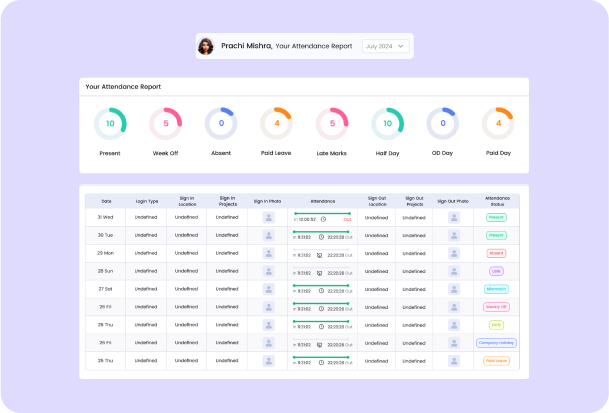

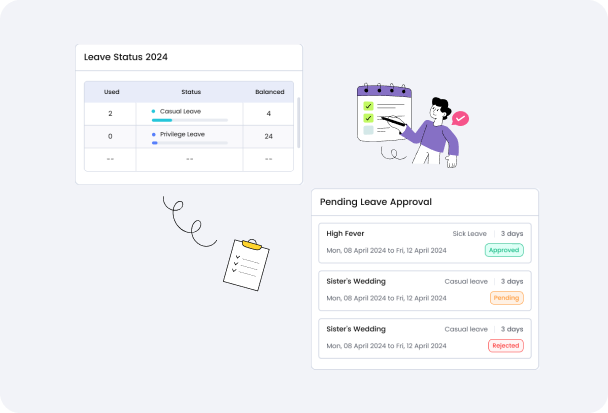

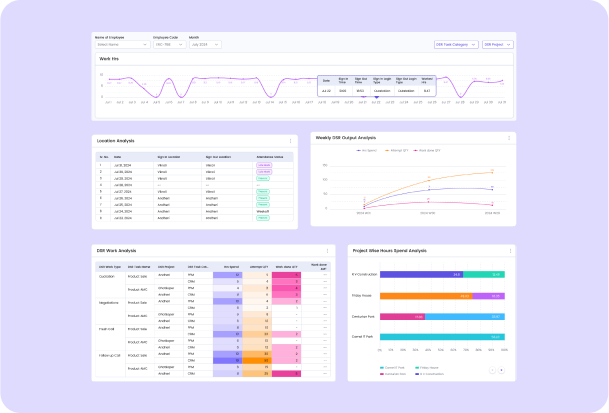

Tax compliance monitoring refers to ensuring that a certain person or business always makes provision for the tax in a manner that aspires to be compliant to the laws and rules that are meant to guide such an institution. Ensuring and ensuring that tax returns must be filed on time and appropriately done taxes paid on or before the due date plus being updated on changes over tax laws. Business firms, especially firms whose businesses are extended to more than one location or those with a complicated system of taxation, must monitor tax compliance. An efficient monitoring mechanism should put a business on the right tracks either concerning local or international tax laws and avoid paying heavy penalties, fines, or even audits.

At the end of the tax year, there are certain set of tasks and activities that people, businesses, and organizations must undertake in an effort to put their financial records and tax filings into a state of preparedness for the next fiscal year. This process is referred to as "Year-End Tax Processing." It is the point where all tax obligations ought to be fulfilled, all relevant documents submittable, and the correct tax records maintained. This step is very important because it lowers the chance of getting fined when paying for tax returns; it gets people and businesses ready for tax returns, audits, and even possible tax refunds. Taxes at the end of the year are usually not very easy, especially in large businesses that have many sources of income, employees, or locations where they conduct their businesses. It is, however necessary for budgeting and staying out of trouble with the tax authorities.

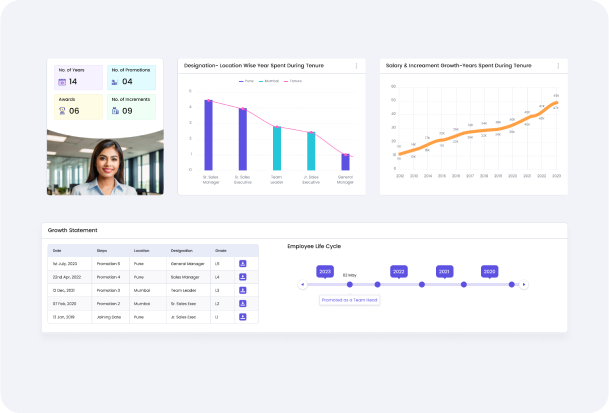

Employee Tax Information Management: The tracking and organizing of the proper use of employees' tax information. This ranges from ensuring that there is tax withheld and employees receive the proper tax forms at year-end, such as W-2s in the United States, to tracking records for purposes of tax reporting and compliance. Businesses and their employees must ensure proper handling of tax information about the employees to avoid penalties, accurate filing of taxes, and honest accounts.

Tax management is highly essential because it will enable proper and timely computation of taxes, hence minimizing the risk of mistakes. This will keep businesses on course since the interpretation of tax rules is proper. Time saved from automatic tax filling is another good reason why a business should have a system for tax management. It prevents loss from deadlines and simplifies the procedures by giving one the opportunity to focus on the growth of the business rather than problems related to taxes.