Ensures that payments to employees are done correctly and on time, which increases the trust factor and satisfaction

In payroll processing, "automated calculations" describe the use of technology-whether payroll software or other specialized systems-to compute taxes, deductions, and employee pay. This reduces errors, saves time, and overall makes payroll management accurate and efficient. Businesses can improve the speed of payroll processing, be tax compliant, and satisfy employees by automating these calculations.

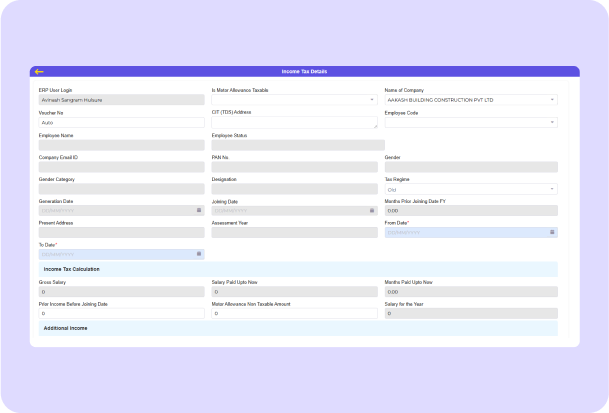

Businesses have systems and procedures in place to ensure that they comply with tax laws and rules. Tax compliance management is the name for this. It means figuring out, withholding, reporting, and paying taxes in a way that follows all local, state, federal, and even international tax rules. Businesses must manage their tax compliance well to stay out of trouble with the tax authorities and to avoid fines, penalties, and other legal consequences. It is a very complex, always ongoing process of following tax rules. It has many varieties of taxes like sales tax, income tax, payroll tax, etc. Tax rules keep changing with time. For correct filing and on time of tax return, a company should be up to date in tax rules.

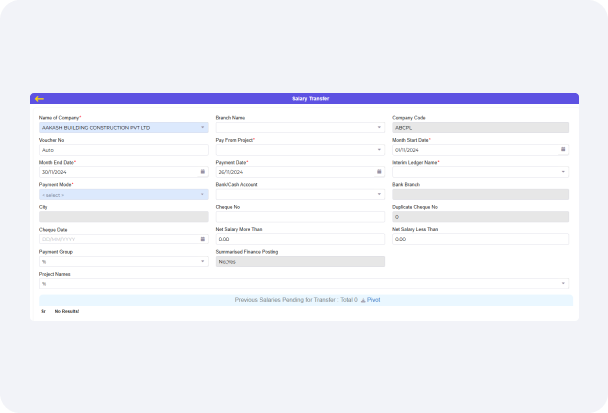

The Direct Deposit Functionality is the electronic transfer sending wages or salaries from an employer's account to the account held by a worker rather than the receiving of his pay in the form of money or cheque. This process is largely accepted because both parties-employer and laborer-it is faster, safer, and convenient in nature.

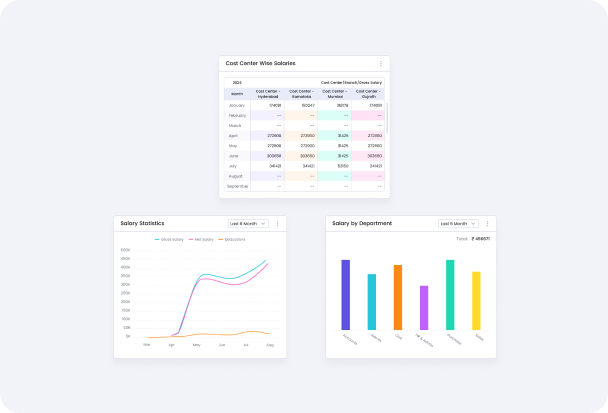

Those reports that could be changed in accordance to the needs of an organization are called as "customizable payroll reports." Based on the requirements of a company, the law of the land and their report presentation, payroll data will have to view by employers, HR departments and the payroll team. Customizable payroll reports will always keep the eye of control over the pay, tax, deduction, benefits of employees, and other payroll matters. Reports of such a kind have been employed by a business, so businesses will always know they are being the law, complete payroll much faster, and make better decisions.

An Employee Self-Service Portal is an online portal where the workers can access, administer, and modify their personal, payroll, benefits, and HR information without having to consult HR or management. ESS portals empower the employee to manage their work-related data. This boosts the productivity, accuracy, and satisfaction of the company's workforce.

Payroll processing is very important because it ensures that payments to employees are done correctly and on time, which increases the trust factor and satisfaction. It also helps the business stay tax compliant by reducing the fine associated risks. It minimizes errors and saves the HR time through automation processes of payroll computations.